Community Economic Development Business Program

Islanders have the opportunity to invest in economic development within their community. Approved CEDBs raise funds by issuing shares to people, and then invest those funds in local businesses.

What is a Community Economic Development Business (CEDB)?

A CEDB is a company or co-operative association registered to sell shares to a community, and to operate and invest in local business. A CEDB can be a:

- company formed under the Companies Act, or

- co-operative association formed under the Co-operative Associations Act

A CEDB must run a business in Prince Edward Island or invest in active businesses in the province. It cannot be charitable, non-taxable, or not-for-profit.

What kinds of businesses can CEDBs invest in?

CEDBs can invest in local businesses that:

- are involved in active business in PEI

- have less than $25 million in assets

- have less than 100 full-time employees, and

- have at least 75 per cent of the wages and salaries paid in PEI

What are eligible investments?

For corporations, eligible investments must be newly-issued voting common shares of the corporation that are non-redeemable, non-convertible, and are not restricted in profit sharing or participation upon dissolution.

For associations, eligible investments must be a share that would, if it were the only share issued to the investor, allow the investor to be a member and to participate in the co-operative.

What investments are considered ineligible?

Funds raised by an eligible business cannot be used for:

- lending

- purchasing shares, other than shares in eligible businesses

- paying dividends

- purchasing services or assets provided by the Crown

- redeeming shares or funding the purchase of all or substantially all of the assets of a previously existing proprietorship, partnership, joint venture, trust company, except where the firm is in receivership or bankruptcy; or

- purchasing assets or services by the eligible business for a price greater than fair market value

How do businesses apply for the program?

Fill out an Application for Certificate of Registration as a CEDB form and send it to:

CEDB Coordinator

PEI Department of Finance

Economics, Statistics and Federal Fiscal Relations Division

PO Box 2000

Charlottetown, PE

C1A 7N8

You must also submit the following documents:

- Complete financial statements for the previous taxation year:

- income statement

- balance sheet

- statement of changes in financial position

- a copy of the T2 income tax return for the previous taxation year

- a copy of the business’ letters patent or articles of association

- a copy of the current shareholders or members register

- a Community Economic Development Plan that provides:

- a description of the defined community the business wants to serve

- a mission statement with the economic development strategy of the business

- the amount of funds to be raised

- a description of the business

- the proposed use of funds, and

- a list of directors

- a letter of non-objection from the Superintendent of Securities that allows the business to issue shares

What happens once a business applies for the program?

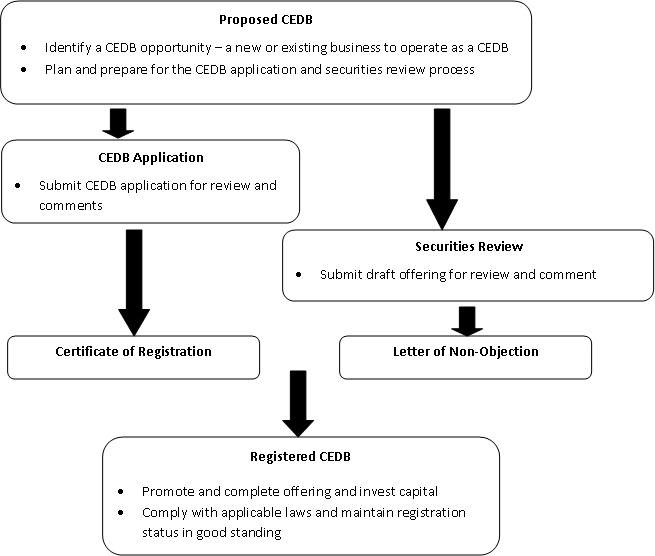

Process overview

Can I get a tax credit if I invest in a CEDB?

You are eligible for a PEI income tax credit if you:

- are a resident of PEI

- are 19 years of age or older, and

- have invested in a CEDB on or after July 4, 2011

The tax credit is calculated at 35 per cent of the investment made by the individual to a maximum annual investment of $20,000. The investment must be made within the calendar year or within 60 days of the end of the taxation year. The credit is not refundable but it can be carried forward for seven years or carried back three years.

The maximum credit that can be claimed in a single taxation year is $7,000. Tax credit receipts are issued by the Department of Finance. Submit the receipts with your T1 Income Tax return for the year.

If you invest in a CEDB, you must hold the investment for at least five years. If you get rid of the investment in this five year period, you must repay a prorated amount of the tax credits.

Are there provincial laws that govern the program?

Community Development Equity Tax Credit Act and the Community Development Equity Tax Credit Act Regulations

Companies Act (639 Kb) and the Companies Act Fees and Forms Regulations

Co-operative Associations Act and the Co-operative Associations Act General Regulations and Fees Regulations

Securities Act and the Securities Act General and Fees Regulations

Do you need information on the CEDB program?

Name/Title: CEDB Coordinator

Telephone: (902) 368-4030

Fax: (902) 368-4034

Email: CEDB@gov.pe.ca